If you’re an investor, philanthropist, or entrepreneur you’ve likely heard something about impact investment and wondered if it’s just a buzz word, old wine in new bottles, or something you should be getting involved in.

So what is it all about?

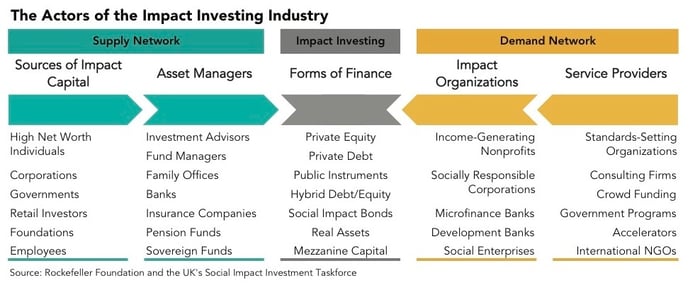

Impact investments are made into companies, organisations, and funds with the intention to generate social and environmental impact alongside financial returns1. Perhaps the simplest way to understand impact investment is to consider it as a step beyond socially responsible and ethical investment to actively seeking opportunities that demonstrably address social or environmental problems. If that impact is not up-front and central to the deal, it’s not an impact investment.

Is it new? What’s driving the movement?

Of course, people and organisations have always invested for reasons beyond financial returns, but the last 15 years has seen a dramatic increase globally in the amount of ‘impact’ capital allocated, the number of specialist intermediaries, and the sophistication with which impact investors operate. There are a number of drivers for this growth. From a macro-societal viewpoint we’ve realized the limits of traditional approaches in addressing ‘wicked problems’, and the notion that we invest for solely economic gain and give/donate solely for social change just doesn’t hold anymore. This approach is outmoded and doesn’t fit with the next generation of entrepreneurs and innovators who apply their talents for profit and purpose2. So as angels, VC’s, and advisers we have to keep our disciplines but refine our assumptions about why everyone is around the table when it comes to impact ventures and deals.

Institutions with sophisticated investment and philanthropic practices such as family offices and foundations are leading some of the big shifts into this class of capital with Campden Wealth reporting that 61% of family offices globally are active or expecting to be active in impact investing. This is driven not just by an increase in a values-based approach to investment, but by increasing evidence of the power of such investments to achieve social impact – something we’ve traditionally relied on philanthropy for. The idea that we can achieve this impact with our investment dollars is therefore an exciting proposition.

How do the financial returns compare to any other investment?

It depends. The definition above covers a big range of instruments and classes which can intentionally range from concessionary returns to beating the market. But choosing to have a positive impact with your investment certainly does not mean giving up on market returns. The return profile of a given fund or investment will depend on the usual commercial parameters, but also depends on the nature of the impact sought and the market being served. We say that returns can intentionally vary because there are many flavours of impact capital that fit with different types of vehicles and sectors – some of which sacrifice some commercial upside in favour of greater impact – and others have their impact and financial returns in growing in lock-step. A good adviser or fund manager will be able to provide you with some transparency and guidance on this.

Are there opportunities for angel investors and VC’s in NZ?

Although we are behind in NZ, there’s no reason why we can’t catch-up quickly. Look where NZ’s new venture / early stage capital markets were 15 years ago! With this infrastructure and market maturity in place we’ve got a great platform to grow from, not to mention the leadership we’re seeing in the Māori economy in investing for more than just profit. At Soul Capital, we’ve put together Australasia’s best impact investment brains to facilitate capital into growing Kiwi impact ventures. And the dealflow is starting to look promising as the market is maturing quickly.

What should you look for in an impact fund or venture?

When we evaluate a venture we need to be convinced by its business model, market opportunity, the team, and other parameters that usually determine any early stage investment. But we also need to be equally convinced by its impact model and its ability to scale with venture. Also vital is the team’s understanding of the systems that create the social/environmental problem in the first place, and how they measure the impact they will make as this is an integral part of the investment proposition.

A good impact fund manager or advisor must understand the subtleties of blending business and impact models alluded to above, be able to run due diligence on the impact side of the equation (not just the commercial side), and ought to have a model tailored for working with impact ventures. Unfortunately, just having an impact screen on your dealflow isn’t adequate.

If you’re interested investing for impact alongside financial returns, Soul Capital are raising an impact fund right now. Drop Jamie Newth or Deb Shepherd a line.

1 The Global Impact Investment Network

2 This is not to say that traditional businesses and non-profits have lost any legitimacy, rather this is why we are seeing, and need to see, growth in impact focused businesses.

This blog post is by Dr Jamie Newth and Dr Deb Shepherd from Soul Capital. Soul Capital is an impact investment organisation that invests in social enterprises and social businesses in New Zealand and abroad.